Tools and Resources to Help You Plan, Budget, and Thrive.

At Rio Grande Credit Union, we believe that everyone deserves to feel confident about their finances. Whether you're just starting out or reworking your financial goals, we're here to support your journey toward financial wellness.

This is your go-to space for free, practical tools that can help you take control of your money and plan for what matters most—without the stress.

Why It Matters

Taking small steps now can lead to big changes down the road. Budgeting isn’t about cutting back—it’s about moving forward with confidence. With the right tools and support, you can build a plan that fits your life and your goals.

Start Today

Ready to take the first step toward your best financial self? Here are some FREE financial resources available to help you become your Best Financial Self!

|

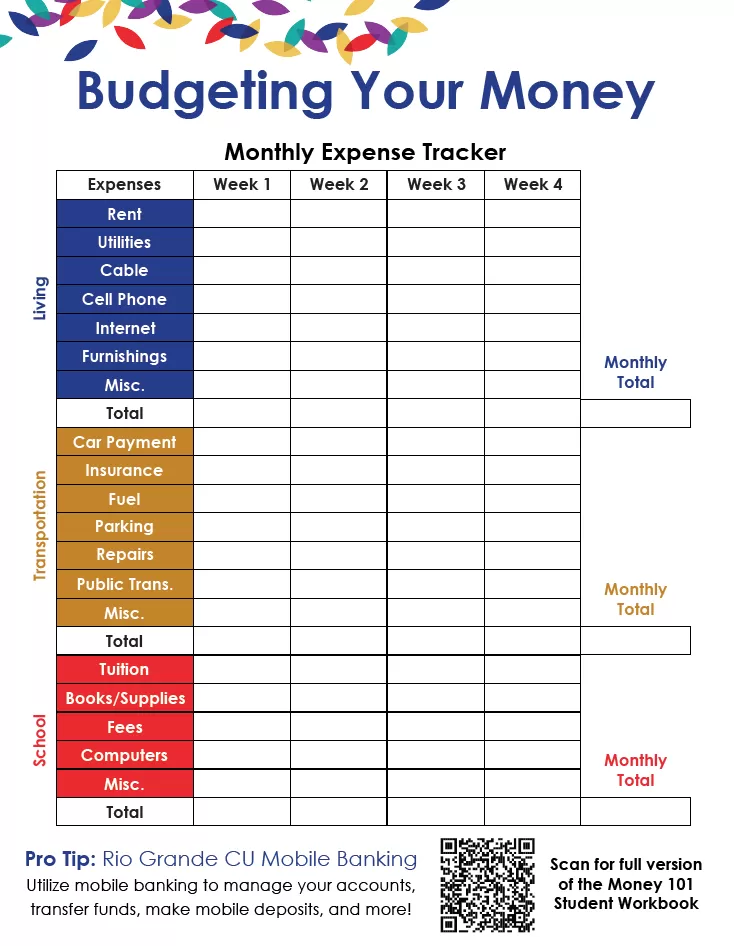

Budgeting Workbook |

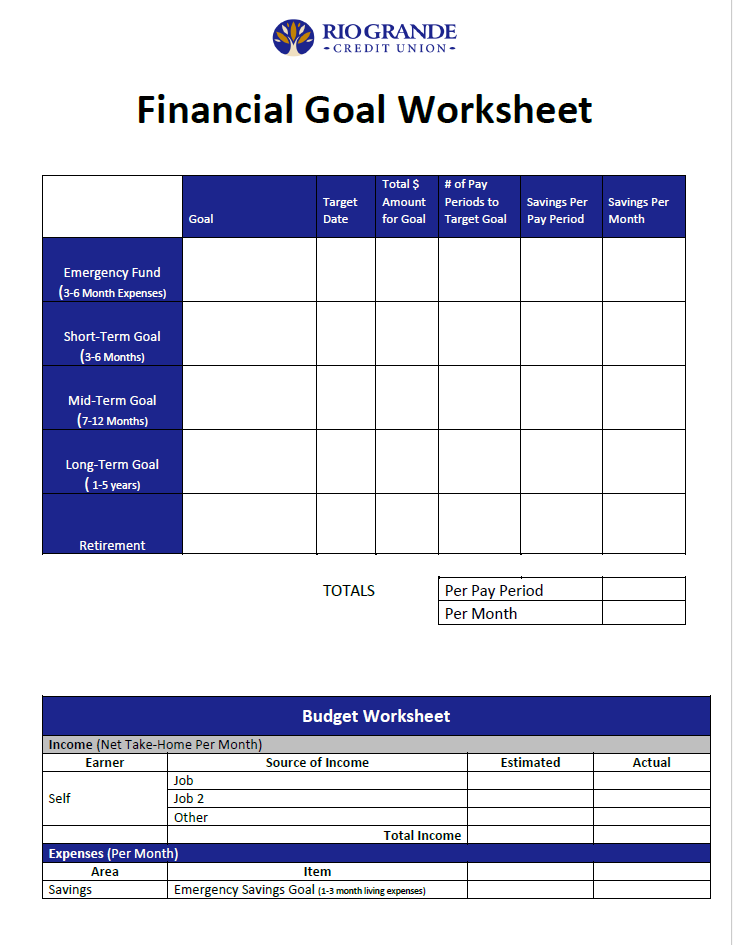

Financial Goals Worksheet |

Free Financial Coaching |

Financial Education Articles |

Financial 411

Financial Wellness Videos

New Blog Articles

March 2026

- Best Time to Pay for Vacations

You know how to save money on vacation when it comes to attractions and dining out, but what about the big-ticket stuff like travel and lodging? We’ve got a guide that’s got you covered!

February 2026

- Avoiding Scams In The Workplace

A lock you might associate with bicycles can be your best laptop security measure. Keep your data safe!

- 10 Myths About Credit Unions

Don’t let myths and misconceptions about credit unions keep you from making your most solid financial choice!

- The Cost Of Poor Credit

If you’re having credit problems, it’s possible to improve your credit score, but not by paying someone to do it. Get the facts!

- Should I Refinance Before I Retire?

Should you refinance before retirement? If you pick the right #mortgage, you can reap significant rewards! can help!

- The 3 Rules Of Smart Money Management

Understanding the core rules can help you feel more confident, prepared, and in control of your finances.

- ATM Jackpotting Scam

With jackpotting, crooks can rob ATMs so they spit out cash. Learn how you can help spot criminal activity, and how to keep safe!

- Teaching Kids the Importance of Saving

Did you have a savings account when you were a kid? Whether or not you did, it’s important for your kids to have one!

- Talking About Money with Those We Love

Talking about money is one of the toughest things for any couple to handle, but we’ve got ways to make it less stressful and more productive!

- Beware of Sport Ticket Scams

The big game is sold out, but you find tickets in just the seats you want for sale online. Should you snap them up? We’ll tell you how to spot ticket scams and what to do if you get bitten!

- Dine on a Dime: Slow Cooker Chili

February is still chilly, making this hearty slow cooker chili the perfect comfort food. It’s affordable, easy to make, and great for leftovers!

- Avoiding Debt: Can It Really Be Done?

- What to Buy and What to Skip in February

Where can you find great deals in February? What should wait until later in the year to buy? Some of the choices might surprise you!

- Your Complete Guide To Identity Theft Protection

If you’re not worried about identity theft, you should be! We’ve got a list of simple steps you can take to keep yourself out of the thieves’ crosshairs!

- Love on a Budget: Ways to Enjoy a Free Date Night

It’s easier than you think to plan a date night together on a budget. We’ve put together a list of more than two dozen ideas, and they might even get you going on your own!

- Common Tax Mistakes to Avoid

It’s tax time! Hoping for a refund? Be sure you don’t make these common mistakes that could cost you time and money!

- Understanding Your Vehicle’s Trade-in Value

Understanding your vehicle’s trade-in value through independent research ensures you get a fair deal. But where do you begin? We can help!

- Saving on Home Renovations

Is it time to remodel your kitchen? We’ve got tips that can save you thousands of dollars and still leave you with the gourmet enclave of your dreams!

- 8 Financially Responsible Ways to Use Your Tax Refund

It’s tax refund time, and you really want to go nuts after being so good the rest of the year. That’s fine, but we’ve also got some great ideas for things to do with the bulk of the refund!

January 2026

- Beware of Digital Kidnapping

Digital kidnapping sounds like a creepy TV plot, but it’s real. Imagine someone taking over your social media life and making it their own! We’ve got tips to help you stay safe.

- What’s a No-Spend Challenge?

Looking to give your wallet and finances a breather? A no-spend challenge can be just the thing to get your head back in the game. Let us show you how to do it!

- Rebuilding An Emergency Fund

If your emergency fund takes a hit, don’t wait to refill it! You never know when the next crisis will come.

- What’s In A Credit Union Membership?

As a member of , you get lots of benefits, from friendly service and great rates to community support and a voice in the way things are run. It’s a great thing!

- Should I shop for a new vehicle or buy a pre-owned one?

Should I buy a new car or used car? It’s a tough decision, with advantages and disadvantages on both sides. Let us help you with our handy guide, and great credit union financing!

- Sliding And Purse Safety

While you’re pumping gas, a “sliding” thief is stealing your purse. Find out how to protect yourself here!

- Impulse Spending Triggers and How to Outsmart Them

It might be a pricey new pair of shoes or that golf club you didn’t know you needed, but impulse buys are lurking everywhere. Find out how to get them out of your wallet!

- Honoring Dr. Martin Luther King Jr.: Why Credit Unions Are Built on His Vision of Service

This MLK Day, we reflect on Dr. King’s vision of equality, service, and economic opportunity for all. Learn how credit unions, like Rio Grande Credit Union, carry forward his legacy by empowering communities through fair financial access and education.

- Ways to Trim Your Fixed Expenses

Trimming your monthly expenses can save you big money in your budget. Look at everything from your mortgage to monthly subscriptions and see what you can trim

- Auto Dealer Finance Scams

Ever wonder how the car finance guy got such a nice office? Hint: Not by letting you get away with the best possible deal. Let play on your team!

- Smart and Safe Charitable Giving

If one of your New Year’s resolutions was to give more to charity, there are a few things to watch out for before you write that check. We can help you donate safely and wisely.

- Why the Right Mortgage Consultant Matters

When you look for a mortgage, a mortgage consultant is an important part of the process. Here’s how to find the right one who will work with you for years to come!

- Steps to Kicking Your Debt in the New Year

If you’ve decided it’s finally time to get out of debt, congratulations! Before you get started, though, you’ll need a plan. We’ve got a ready-made one … just plug in your numbers and go!

- Shopping Hacks for Nordstrom

Believe it or not, even high-end retailers like Nordstrom have shopping hacks that will have your wallet think you’re shopping the bargain bin. We’ve got them all laid out for you!

- Tackling Holiday Debt: Your Guide to a Fresh Financial Start in the New Year

The holidays may be over, but the bills can linger. Learn practical, stress-free ways to tackle holiday debt, regain control of your finances, and start the new year with confidence.

- All You Need to Know About Account Takeover Scams

There are many online scams, but account takeover fraud is probably the worst of them all, letting scammers take control of and drain your accounts. Learn how to protect yourself!

- How do I Raise my Kids to be Financially Independent Adults?

We all want our kids to be successful, and a big part of that is being financially independent. But how do you teach them that? We’ve got lots of tips to help!

- Dine on a Dime: New Year’s Veggie Stir-Fry Noodles

This quick and budget-friendly New Year’s Veggie Stir-Fry Noodles is the perfect light comfort meal after the holidays—packed with flavor, made with simple ingredients, and ready in minutes without breaking the bank.

- Financial Red Flags in Relationships and How to Avoid Them

Money may not buy love, but it can certainly test it. This blog explores common financial red flags in relationships and how recognizing them early can help protect both your heart and your finances.

- Starting 2026 with Confidence and Community

Kick off the New Year with confidence, reflection, and purpose. Discover how small steps, smart planning, and community support can help make 2026 your strongest year yet.

- What to Buy and What to Skip in January

Start 2026 with confidence by learning what’s worth buying in January—and what purchases to skip—to keep your budget on track all year long.

- Your Complete Guide to Vacation Budgets

When it’s vacation time, the last thing you want to do is pinch pennies, but doing just that will make your vacation even more stress-free! We’ve got ideas to help.