Protect Your Loan

Protection & Insurance

A low cost Rio Grande Credit Union loan can make your life a little easier, but what if your life hits a "speed bump?"

Our members are confident when they are fully protected. That's why we offer our members low-cost, full-protection options to safeguard you, your investment, and your credit. For your convenience, these options can easily be included in your monthly loan payment.

Auto Insurance

You May Be Paying Too Much for Car Insurance

You May Be Paying Too Much for Car Insurance

You work hard for your money and even harder to keep your budget on track. So why spend too much on car insurance—maybe hundreds of dollars too much?

Rio Grande Credit Union members may qualify for discounts on car insurance through the TruStage® Auto Insurance Program. You could save big, and it can be easy to switch carriers—without losing any money.

TruStage offers a powerful mix of savings and popular, member-friendly benefits:

- Credit union member discount*

- Nationally recognized companies

- Friendly, 24/7 service—even on holidays

- Discounts for multiple vehicles, safety features, good driving and more*

- Mobile app for easy claims

Don’t wait to see how much you could save.

A Tradition of Strength

TruStage is part of a heritage of faithful service to credit union members spanning more than 80 years. Over 20 million people have selected TruStage for Accidental Death & Dismemberment, life, auto & home insurance and more.

TruStage® Auto & Home Insurance Program is made available through TruStage Insurance Agency, LLC and issued by leading insurance companies. To the extent permitted by law, applicants are individually underwritten; not all applicants may qualify. *Discounts are not available in all states and discounts vary by state. A consumer report from a consumer reporting agency and/or motor vehicle report will be obtained on all drivers listed on your policy where state laws and regulations allow. Please consult your policy for specific coverage and limitations. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. © 2020 TruStage Insurance Agency AUT-2948356.1

GAP

Accidents happen. Get the coverage you need to protect your investment.

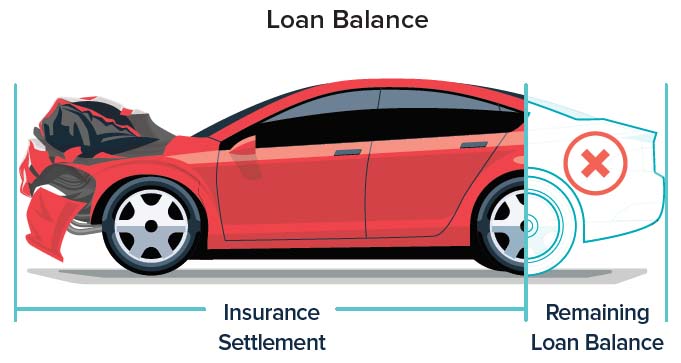

If your vehicle is declared a total loss after an accident or theft, it’s likely your insurance will fall short covering the full balance of your auto loan. This leaves you to pay off the remaining loan balance on a vehicle you can no longer drive—fortunately, we can help.

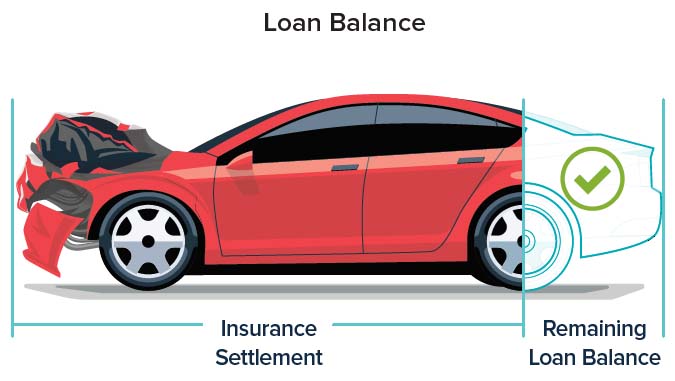

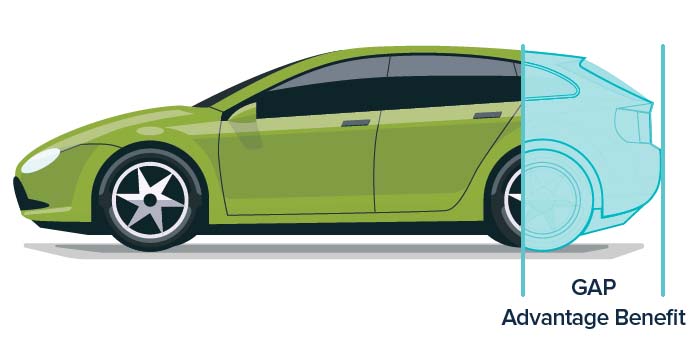

GAP Advantage can pay up to the remaining balance of your auto loan after an insurance payout, protecting you from a financial loss. Plus, GAP Advantage will provide a set allowance towards financing a replacement vehicle with us — getting you back on the road!

How it works

Without GAP Advantage

Your auto investment may not be fully covered

Covered by GAP Advantage

Your auto investment is covered, and additional funds are available to apply toward a replacement vehicle.

Plus funds toward a replacement vehicle

Your purchase of GAP Advantage is optional. Whether or not you purchase GAP Advantage will not affect your application for credit or the terms of any existing credit agreement you have with Rio Grande Credit Union. There are eligibility requirements, conditions, and exclusions that could prevent you from receiving benefits under GAP Advantage. Carefully read the contract for a full explanation of the terms.

Payment Protection

Peace of mind in an unpredictable world

Sometimes bad things happen to good people.

When an unexpected tragedy occurs, Payment Protection can pay off your financed loan in the event of death, or make payments on your behalf if you became disabled. In this day and age, the loss of a paycheck — even temporarily — could cause financial ruin. Payment Protection gives you the kind of security you need in our uncertain world.

Adding Payment Protection1 to your loan can:

- Eliminate all or part of your remaining loan balance

- Protect your credit rating as loan payment obligations are made on your behalf

- Prevent late fees

- Protect your family and your possessions

- Free-up extra cash when it’s needed most

Payment Protection is affordable and may cover both you and your co-borrower. And the cost is factored right into your loan payment, giving you one less thing to think about.

Death and disability is unpredictable and can happen to anyone, at any age. Fifty-six million Americans, or 1-in-5, live with disabilities.2

Are you one of them?

- Every two seconds, whether around the house, on the job, or just being in the wrong place at the wrong time, someone suffers a disabling injury.

- Payment Protection can help safeguard your investment by covering your loan if you or your co-borrower are unable to make payments.

Your purchase of Payment Protection is optional. Whether or not you purchase Protection will not affect your application for credit or the terms of any existing credit agreement you have with Rio Grande Credit Union. There are eligibility requirements, conditions, and exclusions that could prevent you from receiving benefits under Payment Protection. Carefully read the contract for a full explanation of the terms. 1. Payment Protection may be available for personal credit cards, auto loans, personal consumer loans, and home equity loans. 2. "The Facts About Social Security's Disability Program." Social Security Administration, Publication Number 05-10570, January 2018, Web, March 2018.

Vehicle Protection

Protect Your Vehicle from Costly Repairs with healthCAR

We know many of our members are holding onto their vehicles for longer periods of time before replacing them. Often, if you didn’t purchase a vehicle protection plan when you purchased your vehicle from the dealership, you missed out on an opportunity to protect your vehicle with a major mechanical policy.

The more miles you put on your vehicle, the more likely you will eventually have costly repairs. Now, you can protect your vehicle and your pocketbook with vehicle protection from healthCAR.

Benefits of healthCAR Vehicle Protection

- Simplified pricing that’s up to 70% less compared to warranties offered at the dealership

- Affordable monthly payments

- Does not require having an auto loan

- Unlimited mileage protection

- Coverage for vehicles up to 20 years old and never expires as long as premiums are paid

- Great solution if your existing warranty is about to, or has expired

- Great for college dependents driving older vehicles far from home

- Ancillary benefits include roadside assistance that extend to your dependents

- Short 30-day, 1,000 mile validation period

- Coverage level based on mileage of your vehicle at the time of breakdown

- If your vehicle experiences a breakdown, you only pay a $100 deductible

Simple Claims Process

If your vehicle experiences a breakdown, the claims process is as easy as a click of a button. With the healthCAR app, you can begin the claim process to have your vehicle towed to a repair facility of your choice. You can use any licensed repair facility in the U.S. (approximately 91,000). healthCAR pays the repair shop directly for covered repairs and the program owner is only responsible for a $100 deductible.